Monthly Commentary – February 2023

The fund was up 2 % during the month, which is positive given that the stock market in the USA Nasdaq was down 1 % and MSCI World TR

The fund was up 2 % during the month, which is positive given that the stock market in the USA Nasdaq was down 1 % and MSCI World TR

What a start we had to the stock market year 2023 and positive returns broadly across several asset classes. It has been a risk on and risk-taking has paid off

Happy New Year! Finserve Global Security Fund's return for 2022 was 10 % and thus achieved returns of double-digit positive returns. The fund has as thematic

The Finserve Global Security Fund lost 3.0 % in November, mainly as a result of a weaker dollar, which lost about 4.5 percent against the

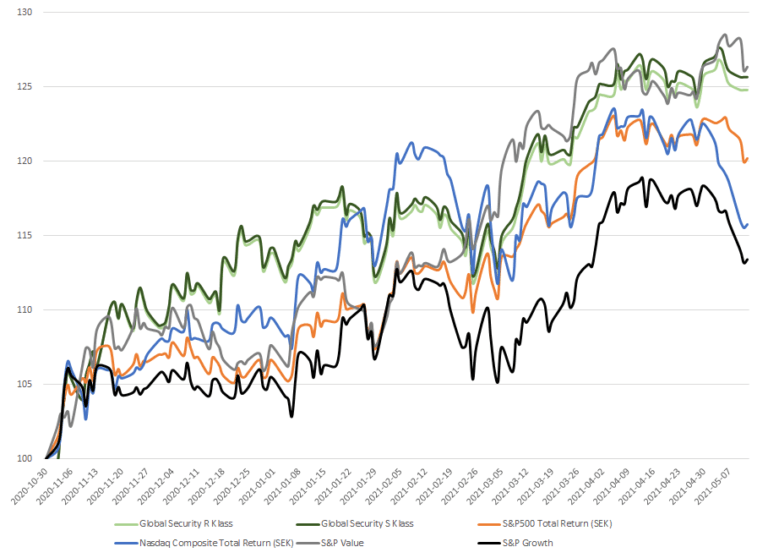

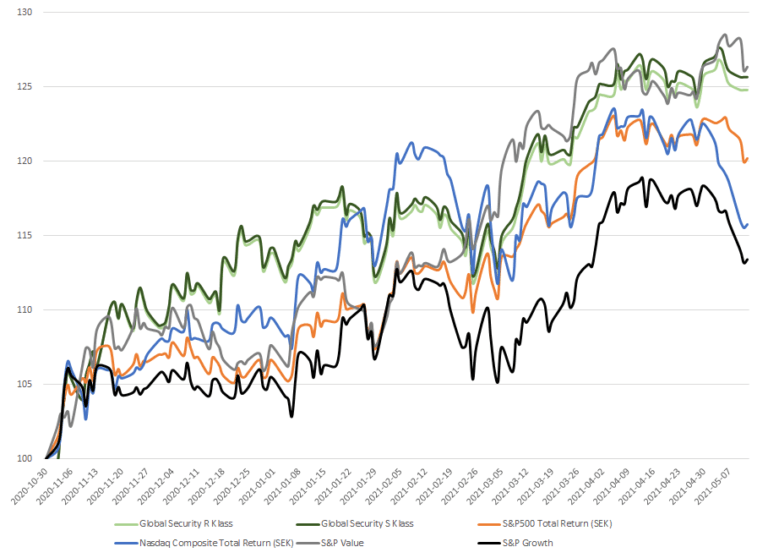

Finserve Global Security Fund had its best month since inception with 12.22 % in returns for the month. The fund is now up close to 20 % too

Finserve Global Security lost during September against the background of broad stock market declines, both in Europe and the US. However, the fund outperformed broad equity indices and benefited from its

Finserve Global Security is going strong in a volatile and uncertain climate and has a selective exposure that is judged to be able to withstand a decline well in relative

July was a strong month for global equity markets. The fund (R class) was up 1.5 % for the month. Inflation data has continued to come in high but the market interpreted

The fund was up, 0.57% for the R-Class during the month, despite strong stock market crashes. The Stockholm OMSX30 index was down - 8.32 % and the global stock index MSCI

The conflict in Ukraine continues to have a negative impact on the real economy and also threatens food supplies in the third world, which could lead to catastrophic consequences and thus

Investing in funds always means a risk. The value of your investment may go up and down depending on factors affecting the market including interest rates. Historical return is not an indicator of future returns. Investors may lose parts or the entire amount invested. For more information on risks, read more in the fund's KIID and prospectus.