Central banks have been convinced that signs of rising inflation will be temporary, but inflation figures from the past week question this claim. On Wednesday, the consumer price index in the US came up with a 0.8 percent increase in the monthly inflation rate. Expectations were an increase of 0.2 percent per month. In the last twelve months, inflation has increased by 4.2 per cent. On Friday, the central statistics agency Producer Price Index, which was twice as high as expected, released 0.6 percent for the monthly figure and an increase of 6.2 percent compared to the year before.

Although it is possible that the increase in inflation is temporary, the latest statistics indicate that the figures are likely to continue to surprise on the upside and that this is the beginning of a rising inflation trend. For example, state aid has, so far, dampened the cost side. It has fueled the other side of the argument; that we are now in a situation with rising inflation and rising long-term interest rates.

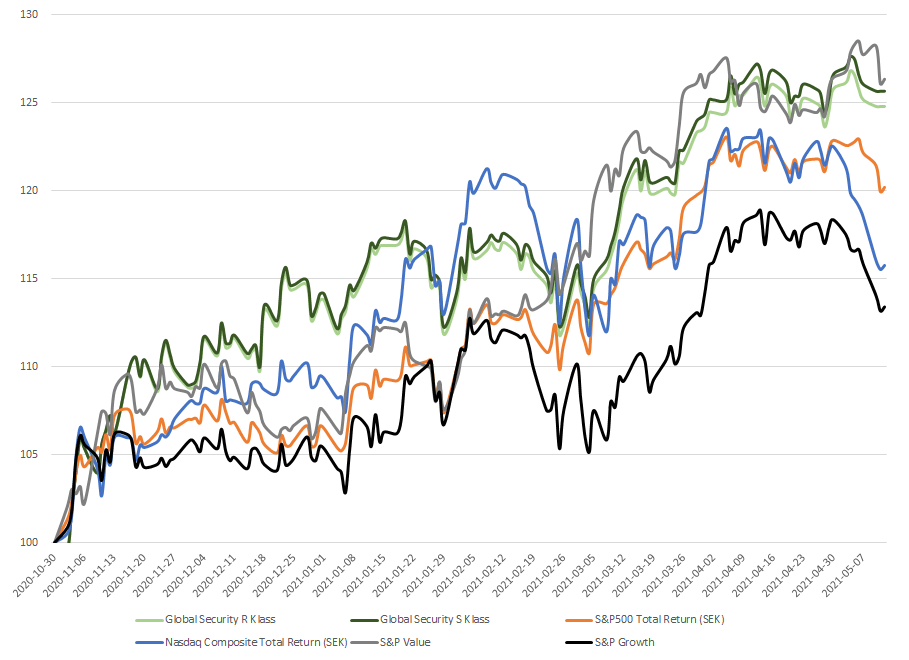

Growth equities have been the main beneficiaries of quantitative easing and low interest rates, but concerns about higher inflation and higher long-term interest rates have seen a rotation from growth and to value equities in November 2020. For the Global Security Fund, which in many cases invests in securities companies, this has the trend has favored the price development of the fund.

Over the past six months, the fund has risen by about 17 percent and many of the holdings have noted significant increases during the same period. However, from depressed levels. Examples include companies such as the aircraft manufacturer Lockheed Martin, the space and defense company Northrop Grumman and the aircraft carrier manufacturer Huntington Ingalls ", says the manager Tor Sinclair and continues:

“Lockheed Martin is today traded around a PE number of 13, which is significantly lower than three years ago, the same pattern applies to many of the other traditional defense companies. We have many large companies that were sold down to inexplicably low values during the pandemic and I believe that the rise during the beginning of 2021 should be seen in the light of this. ”

Tor points out that defense grants and investments in space and cyber security guarantee good growth in the future.

"Defense budgets for many countries that are part of NATO have still not come close to the set goals and there is no evidence of reduced defense funding going forward. Add to that the investments made in the space and cyber industry. The order books look good for the big defense giants and I am optimistic that the order intake will continue to develop well. ”

He further emphasizes that the fund's holdings in cybersecurity have managed the rotation towards value in a good way.

“Fortin has risen sharply over the past six-month period with an increase of about 70 percent. This shows that the rotation is selective and that companies that deliver on growth estimates are rewarded. ”

Tor believes that the historic discount to which defense companies are traded can be explained by the market's great focus on ESG companies. But he also wants to emphasize that the defense industry is a very important sector for the world to be able to achieve its set climate goals and ensure a safe world to live in.

Fund development over the past six months.

“If we are to be able to develop the technology needed for self-driving electric cars, satellites will be of central importance, I think 3D printing will also be a central part in developing aircraft that can take us more energy-efficient between destinations in the future, to this can be added recyclable spacecraft. When it comes to ensuring a secure world and eliminating cyber threats, defense companies will also be at the center. In other words, it is too easy to just point to the defense companies that are at fault in the transition to a more sustainable world. They will be an important part of the transition and benefit from it. ”