Fortinet and Crowdstrike are among the top five holdings in the Global Equity Fund and two companies whose products may have helped prevent the REvil Kaseya ransomware attack that has affected COOP and so many other companies around the world.

The ransomware attack is a reminder of the geopolitical risks that companies face today. A sufficiently harmful attack can knock out many companies in total and it is the increased costs of cybercrime that are driving the growth of cyber security companies.

According to Cybersecurity Ventures, the cost of cybercrime could reach $ 10.5 trillion by 2025, or, to put it in perspective, about 10 percent of world GDP. Even for us at the Global Security Fund, it is almost incomprehensible to understand how big this is.

The American-Swedish cyber security company Recorded Future recently explained in a podcast how interconnected companies are and how a harmful attack can have far-reaching consequences. The fact that you can not buy food in the store arouses media reports regarding the cyber area, but this attack is just one of very many that are going on all the time.

This podcast and many others can be listened to here: Recorded Future

Insurance companies that do not want to pay redemption can force companies to focus more on preventive measures and less on a "cure". Paying a ransom is no guarantee that the problem will be solved, while a large investment in having an updated protection can instead prevent attacks.

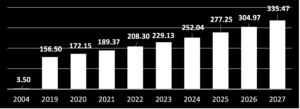

The growth forecast of the cyber security industry until 2027 according to Grandview Research.

The economic consequences of cybercrime are obvious and support the growth hypothesis of the cyber security industry. This is also a reason why the Global Security Fund is investing heavily in this sector. Together with investments in traditional security and space, the Global Security Fund provides investors with exposure to industries that handle increasing geopolitical risks.